If you’ve ever experienced the loss of someone close to you, you’ll know it’s a horrible mix of emotions and is always difficult to come to terms with. This is why it’s important to make sure you have accidental death cover in the event of a fatal car accident.

Your family will be dealing with a great deal of grieving, organising all your personal belongings, arranging the funeral and plenty more. There will be costs involved and the burden of those costs will fall on them. Accidental death insurance makes sure your family has one less thing to worry about financially.

If you already know you want accidental death insurance, complete this simple form and a representative will call you back. Alternatively, you can call your current insurer to find out if they offer accidental death insurance.

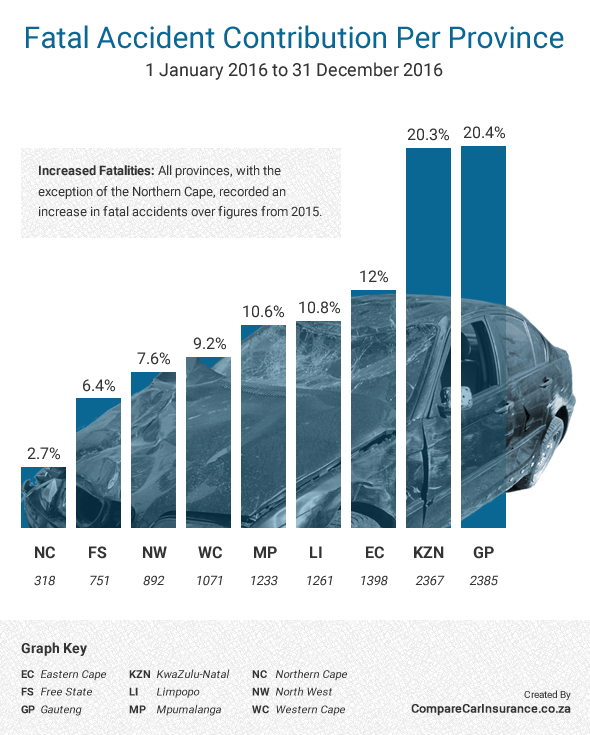

Fatalities Per Province

South Africa has one of the highest road fatality figures in the world. According to the Road Traffic Management Corporation (RTMC) there were 11 676 fatal accidents between 1 January and 31 Decemeber 2016 which resulted in 14 071 deaths.

The graph below shows the percentage of fatal accidents that occurred in each province. Gauteng and KwaZulu-Natal are neck-on-neck for the most dangerous provinces with 20.4% and 20.3% of all accident fatalities respectively.

These are scary statistics, especially considering that they’re higher than they were in 2015. Gauteng saw an increase of 9.9% while KwaZulu-Natal saw a 14.1% increase.

It’s important to note that almost half of these accidents occurred over a weekend. Fatal accidents that happened in Guateng during the working week (Monday to Friday) came to a total of 1287. Statistics for the weekend (Saturday and Sunday) came to a total of 1102. This trend occurs throughout the rest of the country as well.

Accidental Death Cover vs Life Insurance

Accidental death insurance is an insurance policy that applies, as the name suggests, to accidental death. Your family will receive accidental death benefits if your death was cause by any of the following:

- Road accidents

- Drowning

- Fire

- Electrocution

- Hijacking

- Murder

Accidental death insurance is cheaper than life insurance because it only covers a small number of causes of death. If your family doesn’t have a history of health issues and you’re still years away from using a zimmer frame, accidental death cover might be the right cover for you.

Below are some of the companies who provide this kind of cover:

First For Women

Dial Direct

Outsurance

Old Mutual

Conclusion

The number of registered vehicles on the road is growing every year, increasing your chances of being involved in an accident. Regardless of whether you get life cover or accidental death cover, it’s important that you at least have the cover. Death is not something people enjoy thinking about because no one wants to imagine the death of a loved one. Life seldom goes the way you plan and you should prepare for the worst.